inheritance tax changes budget 2021

The rate of tax payable stays at 33. This means no inheritance tax will be charged on the.

Annex 6 Tax Measures Supplementary Information Budget 2021

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning.

. The exact nature of the consultations to be issued has not been announced. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. This is called entrepreneurs relief.

The full Budget Speech package is available at the Singapore Budget website. A vast array of discussion relating to potential Inheritance Tax changes Capital Gains Tax changes and a potential Wealth Tax has taken place in recent months. Following the release of Budget 2022 the 3 main thresholds remain as they were as does the rate of tax payable on any amounts inherited in excess of the thresholds.

Changes To Inheritance Tax for Budget 2022. Budget 2021 - Overview of Tax Changes. Get pensions news and advice.

Tax rates and allowances. The changes in tax rates could be as follows. The tax-free dividend allowance has stayed the same for the 2021-22 tax year at 2000.

Given the rapidly rising values in many asset classes. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. For a table of the main tax rates and allowances for 20212022 click here.

Julie West Solicitors private client solicitor Emma West explains how current allowances work. Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. After much speculation in the press that there would be a complete inheritance tax overhaul Rishi Sunak announced in the budget this afternoon that no changes to inheritance tax would be made.

Your 2021 Tax Bracket To See Whats Been Adjusted. Inheritance tax IHT is levied on an estate when a person has died and is passing on assets so long as the estate in question is valued higher than 325000. The rate of IHT remains at 40.

Here are our key takeaways from the Autumn Budget 2021 for Inheritance tax. 27 October 2021 3 min read Share Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his Autumn Budget on Wednesday. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that.

But what did the Chancellor unveil and what does it mean for you. By Patrick ODonnell 0818 Wed Oct 27. 20 on assets and property.

Proposed changes to Capital Gains Tax. 10 on assets 18 on property. Rishi Sunaks second Budget of 2021 was largely about spending with little movement on personal tax - notably absent again was any mention of capital gains tax inheritance tax or pension tax.

Rishi Sunaks second Budget of 2021 was largely about spending with little movement on personal tax - notably absent again was any mention of capital gains tax inheritance tax or pension tax. Budget 2021 Predictions for Capital Gains Tax Inheritance Tax and Income Tax Following the announcement on 22 February 2021 there finally seems to be some light at the end of the tunnel. Discover Helpful Information And Resources On Taxes From AARP.

This is because you will then have two tax-free allowances. Inheritance Tax changes. Ad Browse Discover Thousands of Law Book Titles for Less.

The following tax changes were announced by Deputy Prime Minister and Minister for Finance Mr. INHERITANCE TAX rules are predicted to change as part of Chancellor Rishi Sunaks Budget which could affect middle-income families experts are warning. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating.

Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you. About any likely changes to Inheritance Tax following the Spring Budget on March 3. While there have been no earth shattering changes to the system of Inheritance Tax in the UK.

Chancellor Rishi Sunak walking tax tightrope to balance Budget RISHI SUNAK has announced the Budget for 2021 and Inheritance Tax has featured in the announcement today. The Government announced earlier this year that on 23 March 2021 they will issue a series of tax consultations. However what is charged will be less if you leave behind your home to your direct descendants such as children or grandchildren.

Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. In some instances IHT bills could. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

Ad Compare Your 2022 Tax Bracket vs. An investor who bought Best Buy BBY in 1990 would have a gain. This could result in a significant increase in CGT rates if this recommendation is implemented.

Only six states actually impose this tax. Heng Swee Keat in his Budget Statement for the Financial Year 2021 on Tuesday16 Feb 2021. In a nutshell everything remains the same.

Much has been made of the Autumn Budget and the changes around Universal Credit and National Insurance but changes to other taxes are sometimes missed when reviewed by the media. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

100 00 For Btc 12 Months Away The 100 Blockchain Electronic Products

Estate Planner Leave A Legacy Not A Ledger Templates For Onenote By Auscomp Com

Moneyvalue Creating Generational Wealth Life Insurance Quotes Term Life Insurance Quotes Wealth

Where S My Stimulus Check Use The Irs S Get My Payment Portal To Get An Answer Irs Estate Planning Checklist Income Tax Return

Annex 6 Tax Measures Supplementary Information Budget 2021

The Telegraph Tax Guide 2021 Your Complete Guide To The Tax Return For 2020 21 Edition 45 Hardcover Walmart Com In 2022 Tax Guide Tax Return Inheritance Tax

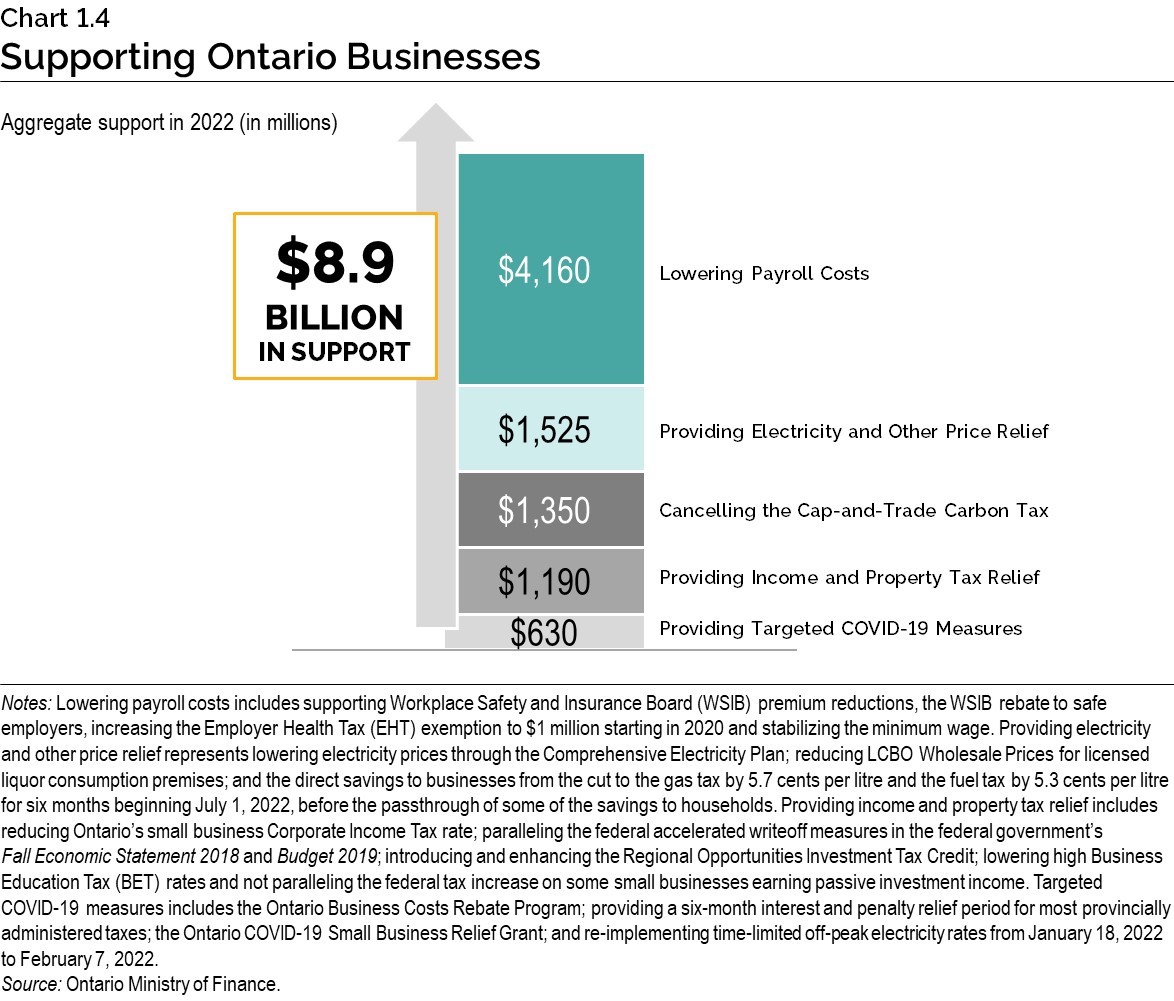

2022 Ontario Budget Chapter 1a

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

4 Dave Ramsey Rules We Broke And Still Paid Off 71k Of Debt Easy Budget Budgeting Debt Simple Budget

1031 Exchanges Explained What This Tax Strategy Means For Investors Investors Capital Gains Tax Real Estate Investor

New 26as Check New 26as Changes Before Filing Itr Tax Deducted At Source Cash Credit Card Income Tax Return

What Is Real Estate Investing In 2021 Real Estate Investing Finance Infographic Investing

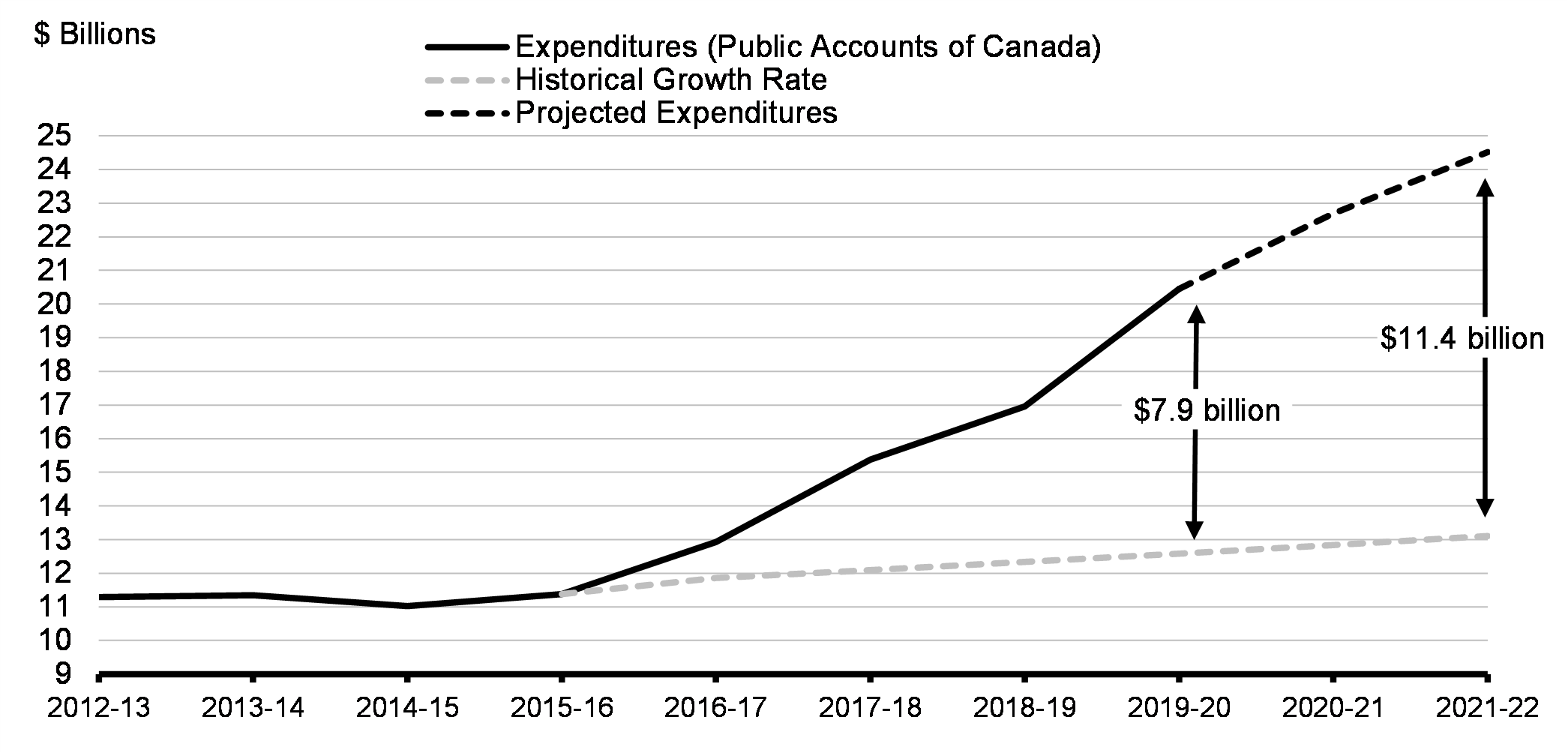

Chapter 9 Tax Fairness And Effective Government Budget 2022

The 70 20 10 Budget Rule Is A Percentage Based Method Similar To The 50 30 20 Budget Here S How It Works And H Budgeting Combining Finances Managing Finances

Can My Father Will Ancestral Property To Anyone He Wants Growing Wealth Estate Planning Ancestral

Budget 2021 Strong Indigenous Communities Canada Ca

Part 4 Fair And Responsible Government Budget 2021

Do I Need Life Insurance Joanne Dewberry Uk Small Business Blog Life Insurance Marketing Life Insurance Marketing Ideas Life Insurance Sales